In short: We build better buy and hold portfolios. With today’s computing power, it’s easy to analyze history to create the “perfect” asset allocation. Financial professionals do it all the time, but they almost always do it the wrong way.

Here’s an example. Let’s say we wanted to create an asset allocation that has maximized return while never losing more than 10% in any given year. Major asset classes like US equities have suffered drawdowns in excess of 50%, so limiting losses to just 10% is a very conservative, risk averse goal.

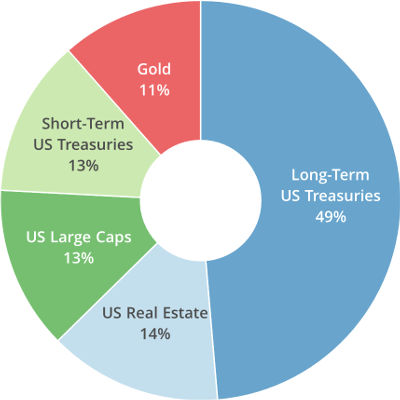

Here we’ve created such a portfolio using sheer “brute force”. This portfolio is arranged to produce the maximum return, while never exceeding a 10% loss in any 12-month period. Since 1970, our brute force portfolio would have gained 9.3% annually. For comparison, US stocks have returned about 1% more per year, but suffered drawdowns more than 4 times as high (*).

These are über impressive returns for such a “safe” portfolio. Ready to invest? Not remotely. There are two big problems with this conventional approach to portfolio building:

- First, it assumes that the future will be exactly like the past. It won’t be. No one knows just what the future holds, but we can be certain that it will be different.

- Second, it’s based on an overly optimistic era for bonds. Bonds are key to a well-diversified portfolio; they’ve provided both consistent returns and consistent diversification against riskier assets like stocks and real estate. But bonds face stiff headwinds in the coming years. That’s not prognostication, it’s a mathematical certainty.

It’s imperative that we account for these fundamental flaws in conventional portfolio building. Failing to do so ensures that we’ll also fail to meet our goals and expectations.

A Better Way

We built this site to address these issues and build better portfolios. Using advanced statistical techniques, our approach to portfolio building acknowledges that:

- The future will be different.

- Bonds face stiff headwinds in the coming years.

Better Way #1: Subset resampling, because the future will be different

The brute force approach shown above looks at just one version of history when creating a portfolio. That means that it’s highly reliant on the future looking exactly like the past. But we know that won’t be the case. As we’ve already mentioned, bonds face stiff headwinds in the coming years. Correlations between asset classes are increasing as economies globalize. The small cap premium is dwindling. Gold and commodities are unreliable portfolio diversifiers. And no one knows for certain how asset classes will interact during the next crisis.

In response, we use a statistical technique called “subset resampling”. We divide our portfolio into hundreds of subsets, optimizing across each of them individually, and then analyzing the combined result. The goal is to reduce “estimation error”, or the degree to which the past performance of the assets doesn’t reflect future performance.

The end result is that we create a portfolio that’s more forgiving to change because it doesn’t assume that history will repeat itself precisely.

Better Way #2: Currentizing bond returns, because bonds face stiff headwinds in the coming years

No one can say with certainty how most assets will perform in the coming years, but when it comes to many bonds, we know that they’ll underperform the past. It’s extremely rare in this business that we can say with mathematical certainty that a given asset class will underperform, but this is one of those few instances where we can (learn more). That means that designing portfolios based on past bond returns, as in our brute force example, is inherently flawed.

In response, we design our portfolios based on current bond yields. Things get a bit technical from here, but in a nutshell, we deconstruct each bond asset’s history into all the constituent factors that drive returns. We assume that the largest driver of bond returns, the current yield, was never higher than it stands today.

That means that our asset allocations will slowly change over time as yields change. That’s okay. Sound buy and hold investing requires periodically rebalancing our portfolio. Those rebalances provide the opportunity to keep up with the optimal allocation. We can also adjust to the optimal allocation when we add funds (by buying assets that we’re under-allocated to) or withdraw funds (by selling assets that we’re over-allocated to).

The Net Effect: Better (More Realistic) Results

The net effect of our approach to portfolio building is that our portfolios are usually more diversified and less optimistic about long duration bond returns. As a result, our portfolios tend to be more conservative (or what we’d term “realistic”) than those you’ll find elsewhere.

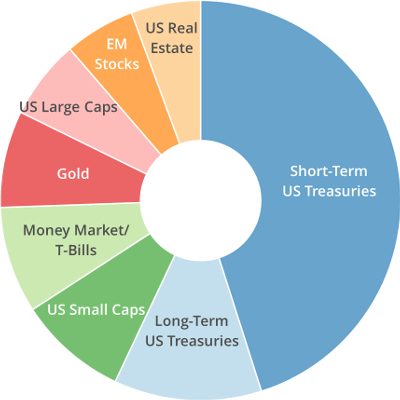

Here we’ve shown one of our solutions to the “never lost more than 10% in any 12-month period” portfolio challenge discussed earlier (*). It’s considerably more conservative, with a large allocation to money market and short-term Treasuries.

It’s important to understand that this portfolio would have underperformed the brute force solution in the past by about 1% annually. That’s okay. We can’t retire on pretty backtests of past performance. All that matters is actual, future performance, and this portfolio is tuned to the market as it stands today.

It’s easy to show investors flashy numbers based on a brute force analysis of history. But if we know that investors are highly unlikely to achieve those results, then they do investors a disservice. It’s much more responsible to provide investors with more realistic results now, before they’ve invested their hard earned capital, knowing that they’re more likely to actually achieve those results in the future.

To learn more about how this site came to be, check out our origin story.

We invite you to take our Portfolio Builder for a free test drive. Become a member for less than a $1 a week to unlock all functionality. Have questions? Please check out our FAQs or contact us.

(*) Data on this page updated 03/31/2019.