We designed the Portfolio Builder to give investors maximum flexibility when assembling their portfolios. We don’t want to force users into specific asset classes or investment objectives. But that wide range of choice might be overwhelming for new users. Here we break down how we as the site developers use BetterBuyAndHold to build our own portfolios.

Step #1: Define the loss limit (i.e. risk tolerance)

Users first select their “loss limit”, or the maximum degree of loss that could be tolerated. We use this loss limit to measure the user’s risk tolerance in place of the usual vague, imprecise terms like “conservative” or “aggressive”. Generally speaking, more aggressive portfolios tend to achieve higher returns over the long term, but often require investors to endure larger losses in the short-term.

Take a moment to think about your own loss limit. At what point would losses cause you to abandon your investment plan? There is no “right answer” – it’s specific to the individual – but it’s an important decision. The loss limit is the primary driver behind the rest of the portfolio creation process.

A few hints on selecting a loss limit:

- Use the gauge to understand how loss limits relate to one another. What’s more aggressive, a 10% loss over any 3-years or a 20% loss over any period? That can be difficult to conceptualize. Use the gauge as a visual clue.

- The loss limit should be independent of the current state of the market. We’re not attempting to time the market, so whether the market has been hot or cold as of late shouldn’t matter.

- The loss limit might be different depending on the purposes of the funds traded. Funds set aside for long-term goals like retirement should be treated differently than funds intended to cover some short-term need like a purchase a year from now.

Step #2: Define the return objective (max return or max risk-adjusted return)

Users next select whether their objective is to maximize return or maximize risk-adjusted return. Both are designed to meet the loss limit, but the risk-adjusted objective tries to do it while minimizing the volatility (swings up and down in portfolio value) that sometimes scares investors out of the market. In doing so, it may sacrifice some degree of return.

Like the loss limit, there is no right answer. Take a moment to think about how you react to short-term volatility. If you know that you do well weathering short-term swings, then focus on return. If you know that you find short-term swings disconcerting, then focus on risk-adjusted return.

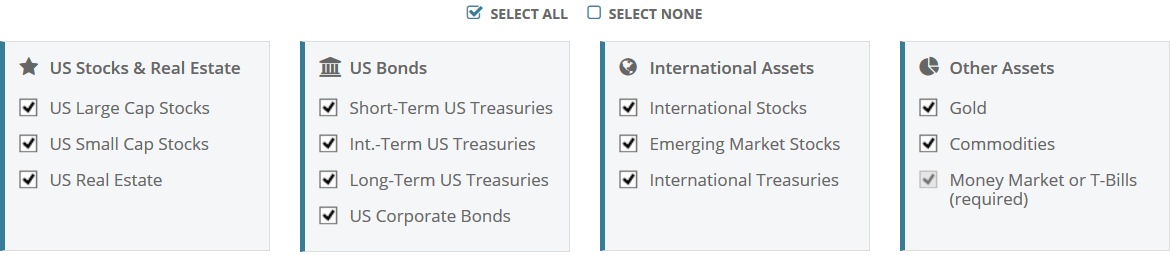

Step #3: Select asset classes

Sometimes there are limiting factors that determine the asset classes selected, such as in an account with predefined asset choices. In that case, the user can select the specific asset classes available. A common sense note: it’s still important to have a reasonably diversified universe of assets to choose from. At the very least, that means a couple of risk assets (stocks and real estate) and a couple of defensive assets (bonds and alternatives).

When all asset classes are available, we use the following process. We’re agnostic to the assets that the Portfolio Builder chooses, so we let the tool decide which assets are most important.

- Begin by selecting all asset classes and clicking “Build Portfolio”. That’s going to result in a long list like this.

- It’s likely that some asset classes have a very small allocation in the portfolio. These will have little impact on long-term performance. Set some threshold below which we’ll exclude that asset – we usually set our cutoff at 5%. Importantly, do not remove all of these assets now. It’s possible that removing one asset could have a knock on effect, so we’ll remove one asset at a time.

- Click “Modify Portfolio” and remove the smallest asset class that’s below our threshold and rebuild the portfolio.

- If there are more asset classes below the threshold, continue from step 3, removing the smallest asset class, one at a time, until all asset classes are above our threshold. Once completed, our previous list should look more like this.

We now have our final asset allocation that meets our loss limit (step #1) and our return objective (step #2), with a reasonably large weighting to all asset classes (step #3).

Step #4: (Optional) Add your own flavor to the recipe

We believe strongly that investors should take personal ownership of their investment decisions, and we would never promote blindly following anyone else’s view.

We’ve put great effort into designing the Portfolio Builder. We know it, we trust it and we do execute the results as shown. But you haven’t been a part of that process, so it’s entirely reasonable for you to add your own adjustments to the results.

Step #5: Execute the portfolio

We’re now ready to actually implement the portfolio in the real world. There are countless brokers, order types, ETFs and mutual funds, etc., and it’s impossible to capture all of the possible ways an investor could execute their portfolio.

Regardless of the situation though, one golden rule holds for all investors: keep costs low. That includes execution costs on your trades, all expenses associated with the ETFs or mutual funds traded, and any other cost that reduces returns without providing value.

Here’s a simple solution that we use for our own company 401k accounts: Fidelity offers commission-free trading on iShares ETFs covering each of the asset classes on our site. That means total execution costs are zero. They also offer basket orders which allow a user to enter allocation percentages for their entire portfolio, and then execute all trades simultaneously as a single basket. That makes executing trades ultra simple.

There are other major brokers that support something similar. You might even be able to improve results further by taking more control over your order execution, especially with a broker more geared towards active trading.

Step #6: Periodically Rebalance

Conventional wisdom says that buy and hold portfolios should be rebalanced back to the optimal allocation about once per year. Our portfolios are a little different in that the optimal allocation is slowly changing over time as bond yields change (read more), so the portfolio will tend to drift from the optimal allocation more quickly.

Here’s our stance on periodic rebalancing:

Plan on rebalancing at least once per year. Consider rebalancing more often if there is a significant difference between the portfolio and the current optimal allocation. Be more generous with your rebalances if transaction costs are negligible as in our Fidelity example. Regardless of costs, there probably isn’t much value in rebalancing more often than quarterly.

Outro

This has been a look at how we as the site developers use BetterBuyAndHold to build our own portfolios. We encourage you to use this as a starting point for your own analysis.

New here? We invite you to learn more about our process and take our Portfolio Builder for a free test drive. Become a member for less than a $1 a week to unlock all functionality. Have questions? Please check out our FAQs or contact us.